Table of Contents

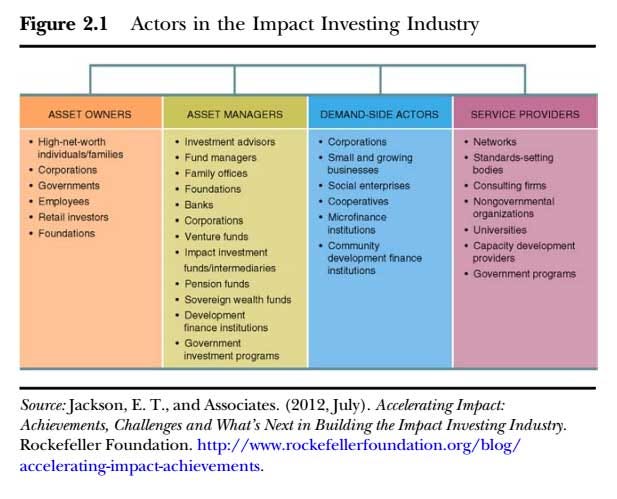

Financial investment firms invest money on behalf of their clients who, in return, share in the revenues and losses.

Financial investment companies do not include brokerage firm business, insurance companies, or financial institutions.

A major type of company not covered under the Investment Firm Act 1940 is exclusive investment firm, which are just exclusive business that make investments in stocks or bonds, but are restricted to under 250 capitalists and are not controlled by the SEC. These funds are often composed of extremely well-off investors.

Controlled funds typically have restrictions on the types and quantities of financial investments the fund supervisor can make. The bulk of financial investment firms are mutual funds, both in terms of number of funds and assets under monitoring.

Investment Management in League City

The very first investment company were developed in Europe in the late 1700s by a Dutch investor that wished to allow little investors to merge their funds and diversify. This is where the concept of investment firm come from, as stated by K. Geert Rouwenhorst. In the 1800s in England, "financial investment pooling" emerged with depends on that looked like modern investment funds in structure.

The 1929 securities market collision and Great Anxiety briefly obstructed investment funds. New safety and securities policies in the 1930s like the 1933 Securities Act brought back capitalist confidence. A number of developments after that led to consistent growth in investment firm properties and accounts over the decades. The Investment Firm Act of 1940 controls the framework and procedures of investment firm.

In 1938, it accredited the development of self-regulatory companies like FINRA to manage broker-dealers. The Stocks Act of 1933 calls for public safeties offerings, including of financial investment company shares, to be registered. It also mandates that financiers obtain an existing syllabus describing the fund. "Investment firm". U.S. Stocks and Exchange Payment (SEC).

Mineral Rights Companies servicing League City

Lemke, Lins and Smith, Policy of Investment Firms, 4.01 (Matthew Bender, 2016 ed.). ACM. 2023.

In retail mutual fund, countless capitalists might be entailed by means of middlemans, and they may have little or no control of the fund's tasks or understanding about the identifications of various other financiers. The prospective variety of capitalists in an exclusive financial investment fund is usually smaller sized than retail funds. Personal investment funds tend to target high-net-worth individuals, including politically exposed individuals, and fund managers may have a close relationship with their client investors.

Easy funds have been growing in their market share, and in some territories they hold a significant part of possession in openly traded companies. There are many various classifications for financial investment funds. For instance, some are closed-end, indicating they have a set variety of shares or capital, whilst others are open-end, meaning they can grow into unrestricted shares or funding.

The prices, risk, and regards to derivatives are based upon an underlying property, and they permit financiers to hedge a setting, increase utilize, or speculate on a possession's modification in value. An investor could possess both a supply and an alternative on the same stock that permits them to market it at an established rate; for that reason, if the stock's cost falls, the alternative still keeps value, reducing the investor's losses.

Whilst thought about, given the focus of this briefing on the crawler of company cars, a full treatment of the useful possession of possessions is outside its scope. A mutual fund functions as a conduit to profit from one or even more possessions being held as investments. Investors can be people, company cars, or establishments, and there are generally a number of intermediaries in between the capitalist and investment fund in addition to between the financial investment fund and the underlying monetary assets, especially if the fund's systems are exchange-traded (Box 1).

Investment Management Companies local to League City

Depending on its legal kind and framework, the individuals exercising control of a mutual fund itself can vary from the people who have and take advantage of the underlying properties being held by the fund at any type of offered time, either straight or indirectly. Both retail and personal financial investment funds usually have fund managers or experts that make financial investment choices for the fund, selecting safety and securities that line up with the fund's goals and risk tolerance.

and act as middlemans between capitalists and the fund, helping with the purchasing and marketing of fund shares. They connect investors with the fund's shares and implement trades on their behalf. handle the registration and transfer of fund shares, maintaining a record of shareholders, processing ownership changes, and releasing proxy materials for shareholder meetings.

Navigation

Latest Posts

Landscape Design Companies

Mineral Rights Companies

Investment Management in League City